Texas is a solar powerhouse, thanks to its sunny climate and supportive solar incentives, making it an ideal place for businesses to switch to solar energy. From business tax credits for solar panels to commercial solar rebates, Texas offers a range of programs to help businesses reduce costs and achieve a faster return on investment (ROI). Here’s how companies can benefit from solar energy and Solar calculator take advantage of solar incentives in Texas.

The Solar Boom in Texas:

Texas is one of the leading states for solar energy in the U.S., with about 8 hours of sunlight on average throughout the year. Businesses in Texas have already started to embrace this energy shift, with nearly 23 gigawatts of solar power installed by the end of 2023. With so much potential, commercial solar in Texas is more affordable than ever, and the state’s solar incentives make it even more appealing for business owners to cut down operating costs.

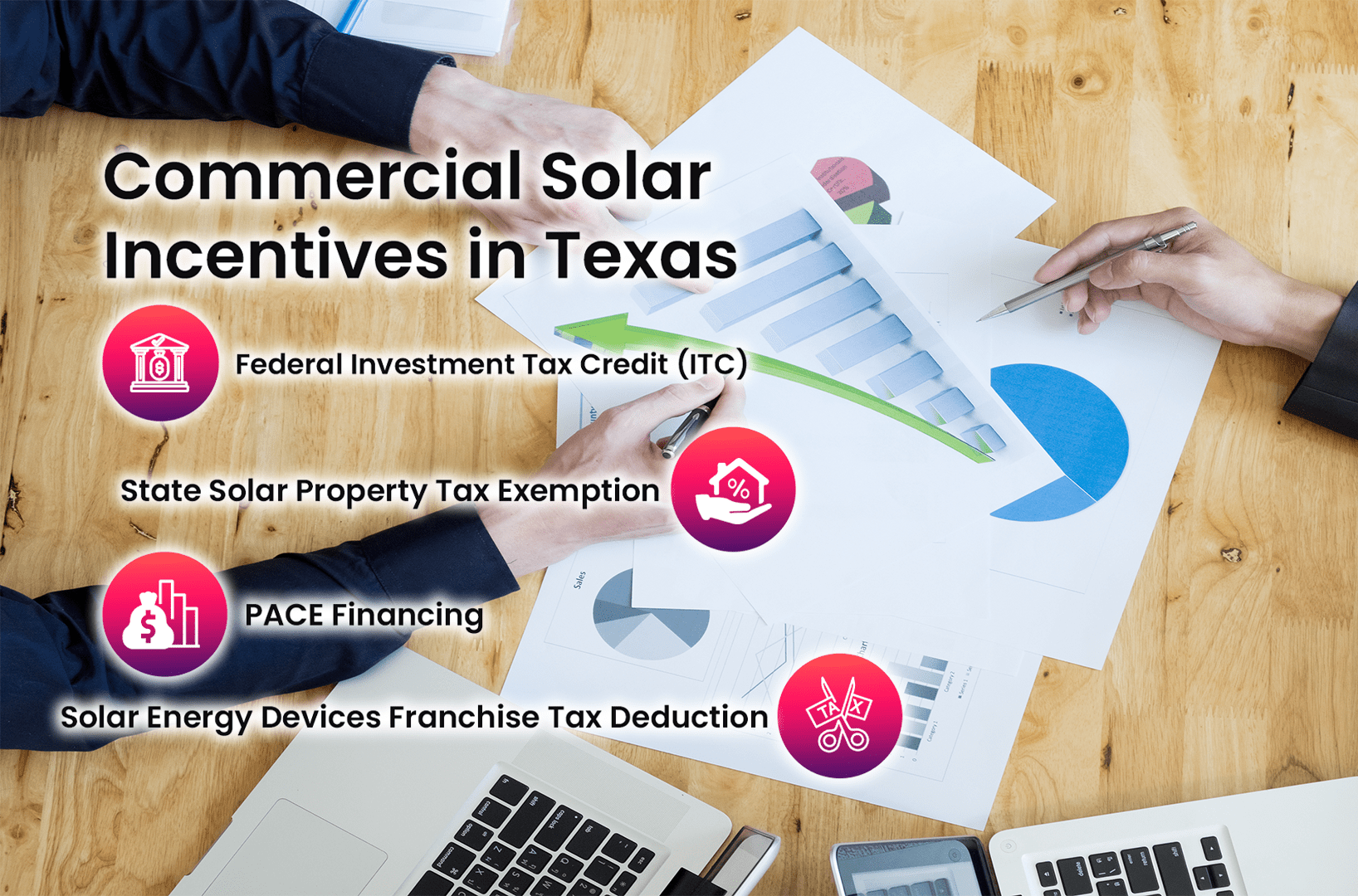

Key Commercial Solar Incentives in Texas:

1. Federal Investment Tax Credit (ITC)

Although the ITC is a federal incentive, it plays a crucial role in making solar energy more affordable. Businesses can deduct 30% of the total cost of installing a solar energy system from their federal taxes. This significant saving encourages companies to adopt solar energy and helps them recover their investment faster.

2. Texas Solar Property Tax Exemption

In Texas, businesses that install solar panels are eligible for a property tax exemption. Normally, adding solar panels increases a property’s value, which would lead to higher property taxes. However, the Texas Solar Property Tax Exemption ensures businesses do not have to pay extra property taxes based on the increased value from solar installations, leading to long-term savings.

3. Texas PACE Financing

The Texas Property Assessed Clean Energy (PACE) financing program allows businesses to receive low-cost, long-term financing for solar and energy-saving upgrades. PACE financing secures funding for solar projects and spreads out the repayment over 10 to 20 years, ensuring that the energy savings often outweigh the repayment costs. Additionally, if the property is sold, the repayment shifts to the new owner, making it a flexible and attractive option for business owners.

4. Solar and Wind Energy Business Franchise Tax Exemption

Another valuable incentive is the Solar and Wind Energy Business Franchise Tax Exemption. This exemption benefits businesses in Texas that manufacture, market, or install solar or wind energy equipment. These companies are exempt from paying franchise taxes, which means businesses involved in the solar sector can save substantially.

5. Solar Rebates and Grants

Local governments and utilities in Texas offer commercial solar rebates and grants to help offset the upfront costs of installing solar panels. These rebates make solar installation more accessible for businesses, further reducing the cost of transitioning to solar energy.

Maximizing Solar Benefits for Businesses

To get the most out of solar incentives, Texas businesses should take advantage of all available programs, including federal and state tax credits, rebates, and financing options. Additionally, investing in high-quality solar panels and certified installers ensures the longevity and efficiency of the system. By pairing solar installations with energy storage solutions, businesses can reduce their reliance on the grid during peak times, improving energy reliability and maximizing cost savings.

In summary, Texas offers various solar incentives for businesses that make the switch to renewable energy financially smart. From tax exemptions and rebates to affordable financing, companies can significantly cut their energy costs while contributing to a greener future. Now is the perfect time for businesses to explore commercial solar opportunities in Texas and start saving with solar power.